Leading Operators – Fitness in Europe

edelhelfer report as of 31 December 2015

The new edelhelfer report once again analyses the largest health and fitness club operators in Europe. In total, already 9.3 million people exercise at the leading 20 providers, an increase by more than one million customers compared to the year before. British and German budget operators show the strongest growth.

For four consecutive years, edelhelfer has been examining the largest health and fitness operators in Europe. To be part of the top 20 by members, operators needed at least 210,000 members at the end of 2015; to be ranked in the top 10 even 430,000 customers were necessary. In total, the 20 companies had over 9.3 million members. Compared to last year, this represents an increase of 13.3% or 1.1 million customers. The approximately 3,300 clubs on average host about 2,800 members each.

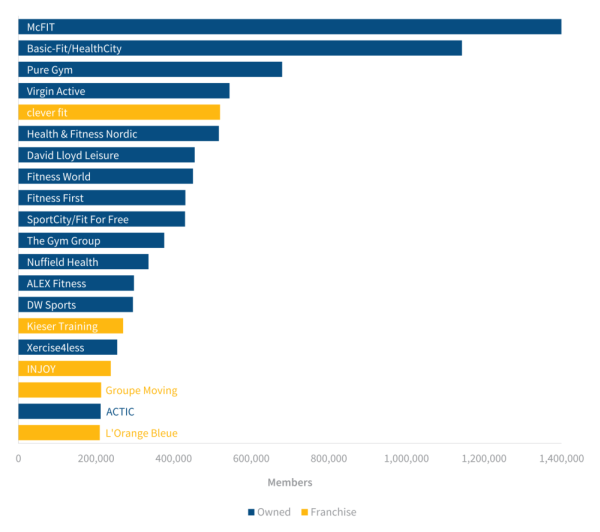

Still, the leading fitness company by members is the German budget provider McFIT. Over 1.4 million people currently exercise in the operator's clubs in Germany, Austria, Poland, Spain and Italy. Germany remains the company’s largest market with 169 clubs. In 2015, McFIT has launched the new club concept High5 in facilities of smaller size and with a price starting at 9.90 EUR in Germany and Austria.

Second-ranked Basic-Fit/HealthCity group realized a growth of almost 50 clubs and comprises now more than 1.1 million members. According to media coverage, the company, which partially belongs to the private equity firm 3i since 2013, plans to conduct an IPO later this year. After the successful going public of the British budget operator The Gym Group (eleventh in the current ranking) in 2015, this would be the next big IPO after fitness operators in Europe had not been present at a stock exchange in Europe for more than a decade. “The realized valuation of The Gym and the efforts of other providers like Basic-Fit or Soul Cycle in the United States show that fitness companies seem not only to be of interest for institutional investment companies but could also attract the general public”, comments fitness market expert and edelhelfer managing director Niels Gronau.

The British operator Pure Gym now ranks third with its approximately 700,000 members. In comparison to last year, the company was able to move up three positions, outstripping established players such as Virgin Active or David Lloyd Leisure. However, the biggest jump of all was realized by the German franchise provider clever fit: Comprising more than 500,000 members at the end of 2015, it improved by five ranks from tenth to fifth place.

This year there are two new providers among the top 20. On the one hand, Xercise4less – another British budget provider – entered the ranking on 16th place. On the other hand, the franchise offering L'Orange Bleue (20), which is active with about 300 clubs primarily in France, is new on the list. Not included in the top 20 is the CrossFit offering. Although, already 2,500 CrossFit “boxes” exist in Europe, they do not meet the required criteria for a fitness club chain with the pure license payment to the CrossFit Inc. Nevertheless, CrossFit would be found in the middle of the top 20 with an estimated total of more than 300,000 members and is definitely a non-negligible market participants.