Leading Operators - Fitness in Germany

edelhelfer report as of 31 December 2014

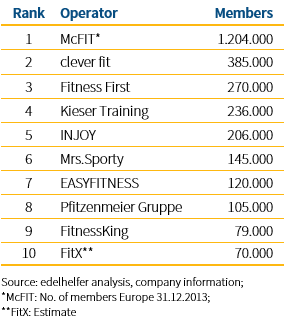

The edelhelfer report "Leading Operators - Fitness in Germany (31 December 2014)" presents the largest health and fitness operators in Germany: Market leader by far is discounter McFIT, followed by franchise provider clever fit and Fitness First. Together the ten leading operators unite 2.8 million members, about one-third of the total German market. With six companies operating in the discount segment, this reflects the growing importance of affordable fitness options. Experts expect further growth for discount concepts, but also for the entire German fitness market.

The new report published by the advisory boutique edelhelfer shows, which German fitness providers are "really fit”. Beside a detailed financial analysis, edelhelfer provide a top 10 of the leading players by members: Therefore 2.8 million people exercise at the ten largest fitness companies in Germany at the end of 2014. This corresponds to a market share of one-third of the 8.6 million total health club members. With the growth of especially the budget operators the significance of the top 10 has increased significantly in recent years. Overall, the ten largest companies grew by 12% in members in 2014.

The largest provider in terms of memberships in Germany and in Europe is still discount provider McFIT with a total of 1.2 million members. Last year, the company has continued its national and international growth. Thereby, a major milestone was the acquisition of the Italian competitor HappyFit with 14 clubs.

clever fit is the new number two on the German market and has realized the largest absolute increase in 2014. Today, the company operates nearly 200 facilities in the budget segment with 385,000 members. With an average of about 2,000 members per club, the clever fit facilities are much smaller than those of other budget companies. This is mainly due to its focus on smaller cities, where founder Alfred Enzensberger wants to continue to grow in future: "Our goal is to achieve a market coverage in small and medium-sized cities. Overall, we envision a potential 13-15% of the population for the German fitness market."

On its ongoing path of repositioning, the German branch of the international Fitness First group ranks third with 86 facilities and 270,000 members. Thus, despite a significantly lower number of clubs, the company today has a similar number of members compared to the former peak in facility numbers. In October 2014, Fitness First had taken over the online platform NewMoove and thereby complements its own branch operations with the offering of a virtual studio.

At a first glance, the placement of the only player being regionally active, Pfitzenmeier Group, seems surprising. With currently 34 clubs in and around the Rhine-Neckar region the company has already more than 100,000 members. The provider founded and managed by Werner Pfitzenmeier is the only company with a consistent multi-brand strategy in the German fitness industry: In addition to its exclusive "Wellness and Fitness Parks" it covers the entire fitness service range with the cheaper "Venice Beach" facilities and the just recently added brand "FitBase" with a price of only Euro 15. Without considering franchise concepts, Pfitzenmeier even reaches third place with respect to members after McFIT and Fitness First.

FitnessKing and FitX are new in the top 10, ranking ninth and tenth. In recent years, both companies have achieved a strong growth in the budget segment. While FitnessKing is principally engaged in the west of Germany, FitX now covers the entire national market. This underlines the growing importance of budget offers in the fitness industry: Six of the current top 10 providers operate in this segment and combine 1.9 million members. Since the establishment of McFIT in 1997 a new segment in the industry with about 800 facilities has been formed, where customers can workout at prices from Euro 15 to 30. While market leader McFIT had increased its prices by Euro three to Euro 19.90 per month at the beginning of 2013, its competitors, and in particular FitX, are entering the market with prices starting at Euro 15 today.

Fitness industry expert and managing director at edelhelfer Niels Gronau expects that the expansion of the budget fitness providers will continue in future. "Budget operators will not be the only concepts to grow in the industry: Operators of comprehensive fitness and wellness facilities such as Pfitzenmeier or MeridianSpa on the one side and niche concepts such as the provider of functional fitness CrossFit on the other side already show that higher-priced operations can be successful in the market, too."